Regina Wamuyu Githaiga purchased a ticket number 003096663 for Sh65 on December 3, 2005. She was given part ‘A’ of the ticket and the First Lotto sales agent — at an outlet managed by Sammy Kariuki Wambugu — retained part ‘B’ and ‘C’ of the coupon as per the rules

Her combination won a jackpot of Sh12 million during a draw the next day. Excited, she rushed to the company to claim her prize, but soon learnt that getting her Sh12 million would not be a walk in the park.

Wamuyu presented her winning coupon on December 6, but the joke was on her. The lottery she had won was only in her dreams. The company disowned its own tickets and said no one had ever won the jackpot on offer.

Shocked, she moved to court, but the firm rushed to block her application as well as challenge the jurisdiction of the court. Presiding judge Festus Azangalala allowed the case to proceed to trial as he noted that a few issues caused him anxiety in the application.

One issue was the rules and regulations section of the lottery, which stated that winning claims would only be paid out upon comparison with and verification of slips “A” and “B” . What left the court more bewildered, however, was the rule that warned that, notwithstanding anything contained in the rules, “the verification of any winning number shall vest with First Lotto Ltd and such decision on verification shall be conclusive and final”.

Playing lottery

The other rule was that, in playing the lottery, the purchaser agreed to be bound by the regulations. In short, the company had the power to decide if you were a winner or not, regardless of what your coupons said, at the verification stage. Wamuyu believed she had won Sh12 million based on the rules of the lottery. First Lotto told her to stop hallucinating. She had won nought

The stories had been catchy, the photos charming, and the dummy cheques mouthwatering. This was gambling on steroids. Money was falling from the trees and Kenyans were scrambling for the windfall, placing bet after bet after bet. For the men and women behind the curtains of swanky offices, this wasn’t betting; this was manna. Mouthwatering manna. For the house never loses.

First Lotto, one of the betting firms cashing in on the craze, was basking in the glee of a successful popularisation campaign. It announced that anyone who played its lottery game, based on the numbers between 1and 49, and complied with the rules had a chance to win huge cash prizes during a draw every Sunday on live TV.

Guerassim Nikolov, the flamboyant, charming but ruthless Bulgarian billionaire who several years later would emerge as the main engine behind SportPesa, was the man behind the blitz. It was his first shot at betting, which he had imported into Kenya months earlier with the help of former Nairobi Mayor Dick Wathika.

Five years later, on the last weekend of 2010, excited employees of First Lotto, which ran the Toto 6/49 lottery, woke up to go to work, like they had done the whole of that year. This, though, was not just any other working day; it was the most important moment in the history of the company as its biggest jackpot of Sh20 million was up for grabs.

Empty offices

Eager workers arrived at the company’s headquarters in Parklands, Nairobi to find empty offices. Almost everyone had vanished, except about four bewildered colleagues, among them technicians, the human resource manager, an accountant and a supervisor who was running the show. None of them had any answers on what had just happened

With the firm closed abruptly on the morning of its biggest bet yet, ticket sellers were now carrying worthless coupons. Hopeful punters, who were expecting to be winners of what was Kenya’s biggest jackpot prize at the time, were chasing wind.

Guerassim Nikolov, who would months later set up SportPesa, had done a disappearing act, and there was little his loyal workers could do about that. The first instinct was to grab whatever was left of the company’s assets as compensation for the period they had gone without pay. A supervisor took off with all the daily ticket sales. A driver drove off with a pick-up truck that has never been recovered to date. The rest grabbed whatever assets they could lay their hands on.

The company that Nikolov had founded, and which had propelled him to his fortune, had simply disappeared from the surface of the earth. And that without paying the jackpot it had promised.

Bulgarian director of SportPesa Gerassim Nikolov

In 2008, Fidelity Commercial Bank, now SBM Bank, filed a winding up petition against First Lotto over a Sh3.6 million debt. Granting the request, High Court judge Luka Kimaru directed that the company be wound up “on account of its inability to pay its debts” and asked Fidelity Bank to appoint a liquidator for the purpose of winding up the company.

And with that, First Lotto Limited ceased to exist, both physically and legally. The next stop for Nikolov and his Bulgarian friends was SportPesa.

With the billions flowing into SportPesa, Pevans East Africa Ltd, the cash cow of the Nikolov empire, embarked on an expansion phase. In a short while it opened companies or offices in Tanzania, South Africa, the Isle of Man, the United Kingdom, the Canary Islands, Russia and Italy.

But it is the local subsidiary, Bradley, that shows that despite Nikolov’s high perch, the notoriety of his past hung on him like white on rice.

Bradley, whose main brand was the Pambazuka lottery, was launched in May 2016 and, by the time it closed shop slightly less than two years later, had accumulated losses of more than Sh1.5 billion ($15 million), which were written off in the books of Pevans in its 2018 accounts.

An insider, however, says that the main reason for its closure was unethical practices. For example, the spouse or fiancée of one of the employees in the IT department, which was the heart of its operations, somehow on November 1, 2017 won a lottery of Sh20 million, making her one of the first people to win.

However, CEO Paul Kinuthia, on learning of this win, got suspicious of the coincidence that the lover of a senior staff in the IT department was the winner and had the employee immediately arrested. However, before charging him in court, the company pressured Kinuthia to release the employee to avert a hostile reporting crisis. The money was paid.

Earlier, in July 2017, a man named John Friendrich had claimed that he had won the Jackpot of Sh109 million and the media went to town with the story. When the money was not forthcoming, he sued SportPesa and Bradley. It is not clear what became of the case.

After Bradley was hurriedly shut down to avoid any more liability on the directors, it appears that top executives at SportPesa forgot there were funds in its accounts, until two cases came up against the company. Bradley’s accounts, it appeared, were now being used for other purposes, including wiring money to entities abroad.

Now, the Bulgarians at SportPesa are generous people. Suggesting they shipped out all the billions they minted in Kenya would be unfair. But their generosity was not for everyone.

Nikolov, who had worked himself up from a croupier in a casino in the Bulgarian capital of Sofia, to a billionaire in Kenya, understood just what money in the right pockets could do.

First Lotto Ltd

If he failed to get his way through the front door, he would open his purse strings and shower whoever mattered with kindness, and the back door would be swung open for him. On his website he lists one of his successes as working closely with the disadvantaged and boasts employing 10 per cent of his workforce at First Lotto Ltd from the disabled community.

Away from charity, however, the deep pockets of the man wanted in Sofia were felt by the right people in the right places in Nairobi. Politicians. Cabinet Secretaries. Principal Secretaries. Key figures in Parliamentary leadership committees. A section of the State Law Office. Name it. There was also enough money to get lawyers who would get judges to grant them favourable injunctions whenever it got to that.

He, however, ran out of luck when the government woke up one day and decided to tighten its controls on the betting industry. SportPesa protested and threatened to close shop, citing an unfavourable operating environment. The government stayed put, and the fortunes of the betting giant that had taken over the country and was splashing billions of shillings in big football and motoring sports abroad started falling.

Nikolov, sensing defeat, decided to sell the perception that he was connected to the First Family. Whether he was or wasn’t remains unknown, but what we know is that, in the middle of the crackdown against betting companies, he transferred one share of the empire he had built to Peter Kihanya, a cousin of President Uhuru Kenyatta, hoping to get some reprieve by association.

The reprieve did not come, and his decision only generated more friction in the board. Nikolov defended it through a series of emails, but it was clear that no name-dropping would get him back his licence to operate in Kenya.

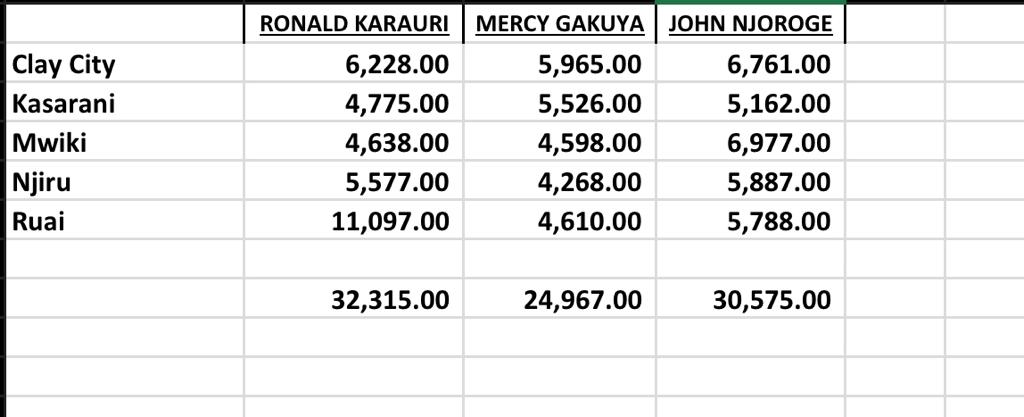

This year, as SportPesa prepared to come back through Milestones Games Limited, he went for James Muigai Ngengi, a nephew of the Kenyatta’s, who reportedly owned a significant stake in Milestones before the firm was handed over to the SportPesa chief executive Ronald Karauri and his allies. This, too, did not work.

But more drama had happened behind the scenes before the entry of Milestones. Of particular interest were happenings in Parliament around the same time the government cracked down on foreigners in the betting industry. The Senate’s Justice and Legal Affairs Committee dropped everything before it and hurriedly called a meeting during which it faulted the Ministry of Interior and Coordination of National Government for frustrating foreign investors.

The legislators lamented that the government was unfairly treating owners of Nanovas K Limited, trading as BetPawa, and SportPesa, among others

“There is accumulation of contempt of court and violation of fundamental human rights,” the committee’s vice chairman Mithika Linturi said, warning that no one is “above the law to crumble anybody as they wish’’ .

But it is the National Assembly’s departmental committee on Finance and National Planning that was the boldest. Somebody in the Finance Committee secretly sneaked in a last-minute amendment into the Finance Bill that effectively dropped a 20 per cent excise duty on bets staked, and caught even the Treasury Cabinet Secretary unawares.

The Sunday Nation can now reveal that an obscure group identified only by a non-existent URL — shade.co.ke — was the secret architect of the scheme to tinker with the betting taxes. The committee said it had received submissions from Shade on May 15, around the same time the country was focussed on combating the Covid-19 pandemic.

The taxed had “made many betting firms cash-strapped, hence cutting down on their sponsorships to local sports clubs”, the group argued in its submissions to Parliament. The Finance Bill was then quickly forwarded to President Kenyatta, who, pressed for time, signed it.

Exposed scheme

The Nation exposed the scheme, forcing Treasury CS Ukur Yatani to disown the amendment at a press conference where he stood shoulder-to-shoulder with a furious Interior CS Fred Matiang’i. Yatani promised to reverse the law in six months while Matiang’i condemned Parliament for working against the government in cleaning up the sector.

How the amendment escaped the hawk-eyed bureaucrats at the National Treasury and the office of the President remains as puzzling as it is intriguing. Shortly afterwards, the Finance Committee’s chairman Joseph Limo was dropped. It is not clear to date whether this was linked to the sneaked-in amendment. Reversing the tax law would require at least six months, which expire at the end of this month.

Shade, the obscure group, had also asked for more amendments, which included a reduction in withholding tax on players’ winnings from 20 per cent to 10 per cent and exempting the betting industry from digital services tax. These did not see the light of day.

Kasarani MP and Milestone Games Ltd., CEO Ronald Karauri meets a phantom “winner” of the SportPesa jackpot, identified as influencer Osama Otero who promotes the brand on his Twitter handle.

* * * * *

August 2019. The lavish SportPesa boardroom at Nairobi’s Chancery Building on Valley Road is becoming uncharacteristically hot. The firm’s fortunes are skating on thin ice and its directors are under extreme pressure from the government. But they have disagreed on a common strategy to respond to the sustained crackdown that is now grinding their nerves. Tempers are flaring.

Shocking secret offshore transactions running into billions of shillings are being unmasked. Emails are flying in from Dubai and other hideouts of the Bulgarian shareholders. The exchanges are getting ugly.

It is just a matter of time before what started as a minor shareholder disagreement snowballs into a full-blown boardroom war that would end in a coup that kicks out chairman Paul Ndung’u.

In one of the email exchanges, Paul Kinuthia, the Chief Executive Officer of Bradley, a SportPesa subsidiary, asks the Bulgarians and SportPesa boss Ronald Karauri to step back and stop attacking the government publicly. He has read the writing on the wall. And it is ominous

NARROW WIN: SportPesa CEO Ronald Karauri’s slim win was occasioned by bribes from Nikolov to the Returning Officer to ensure his interests in parliament are protected.

He offers that a confrontational strategy would not work against the Matiang’i onslaught. Kinuthia prefers to solve SportPesa’s problems with the authorities quietly, but Nikolov does not want to hear any of it. He chooses to stick his head in the raging fire.

Nikolov also does not want to pay Kenya Revenue Authority, which is breathing on the back of SportPesa over tax arrears running into Sh14 billion, a penny, at least not until SportPesa gets its licence back.

But Karauri, a former pilot who loves the fine things in life, and who, perhaps from his training, likes to take the safe route when caught in tight spots, and who, too, is Nikolov’s right-hand man, is wavering in the middle this time round.

Frustrated, Kinuthia asks to cash out the shares he was promised in a Dubai-based payments platform firm, PegB Technology. Nikolov’s sister, Valentina Valya Mineva — a former employee of the Bulgarian state-owned lotto who also helped Nikolov run Toto 6/49 in Kenya, and who wholly owns the Dubai firm — tells Kinuthia to get lost.

The ownership of PegB and KenTech had earlier opened a new battlefront for the SportPesa billionaires, and PegB was one of the companies used by the Bulgarian directors to siphon money out of Kenya through inter-company transactions.

For instance, in 2018, the firm received Sh1 billion (US$9,8m) as “payment processing fees” from another SportPesa subsidiary, Tech Pitch Limited, based in Kenya. Tech Pitch, which provides technical and operational support to SportPesa, including customer billing, bulk SMS and website hosting, receives money from SportPesa through Pevans in Nairobi.

PegB is also the single supplier for Tech Pitch, and it received around 70 per cent of all of Tech Pitch’s reported operating costs for 2018. The firm pays zero per cent tax on its profits in Dubai.

In one of the emails from December 2019, Kinuthia says PegB had received up to Sh3.4 billion from Pevans shareholders through Tech Pitch Ltd in the previous two years.

“Based on this amount, my five per cent shares at PegB Technology are worth over Sh170 million. However, I have discounted this amount and requested Valia to compensate me with Sh50 million,” he writes in an explosive email copied to all directors.

He claims that when he communicated to Valia Nikolaeva to compensate him for the shares, she denied that he was a shareholder at PegB and threatened to take actions against him.

“Please take note that I will not allow to be abused and defrauded (of) what is rightfully mine because I am a minority,” he writes, threatening to take action against Valia, Peg B and all those who assisted her to siphon money out of Kenya by cheating shareholders that the money would be used to build a company in which all will have a stake.

“Note that the actions which I will take will have an impact on all your investments, both locally and internationally, (Pevans East Africa Ltd, SportPesa Isle of Man, SportPesa UK, SportPesa Tanzania, SportPesa South Africa and Kentech Spain) and any other Jurisdictions getting services from PegB Technologies,” Kinuthia warns. Valia remains unmoved.

Valia also wholly owns KenTech, a “computer programming and consulting services” company based offshore in the Canary Islands. KenTech’s entire revenue of Sh451 million ($4.1m) came from a single “main client”, thought to be SPS Sportsoft in the UK, another SportPesa firm. KenTech pays four per cent of its profits in the Canary Islands.

Both Valia and her brother Nikolov also appear to have received generous personal benefits in the form of salaries and other perks from these outflows. For instance, in the year under review, Tech Pitch paid Nikolov a director’s remuneration package of Sh196 million ($1.9 million) despite the company’s entire wage bill being booked as Sh19.4 million ($190,000). And in the Canary Islands, Valia’s’s dividend, salary and allowance package appears to have totalled €300,000, or Sh35 million.

All these revelations were getting some members of the board very jittery. For instance, Ndung’u questions the commercial rationale for paying “payment processing fees” to a Dubai company when 99.9 per cent of all betting payments were being handled locally in Kenya by either Safaricom’s M-Pesa or Airtel’s Mobile Money.

But there was a bigger fight outside the boardroom. UK fraud detectives had placed them on their radar. Auditors and banks were resigning.

* * * * *

The clean-up against betting firms started in May 2019 after a Sunday service at the Christ is the Answer Ministries in Nairobi attended by President Uhuru Kenyatta and his interior CS Matiang’i. As the President sat pensively at the front row, the presiding Bishop at the time, Rev David Oginde, wondered why he was comfortable leading a country of gamblers.

After that session, the Head of State asked his right-hand man, Matiang’i, to get him a brief on what was really happening in the betting industry.

Matiang’i went digging reported the grim facts to State House. Besides the growing number of teen suicides, more than 500,000 youth aged between 18 and 25 had been blacklisted by the Credit Reference Bureau. They had borrowed, placed bets, and lost. Now they could not pay.

VIDEO: Former Interior CS Fred Matiangi waxing lyrical against betting yet he was the henchman tasked by former President Uhuru Kenyatta to engineer and execute the SportPesa Heist from its original shareholders.

The Kenya Association of Manufacturers complained that onsumption of key products was on a decline, while heads of universities said students were routinely missing lectures, and when they did, half of their time was spent on their phones, betting.

Matiang’i also revealed that the average income of most gamblers ranged between Sh5, 000 and 10,000 per month. He instructed the Inspector-General of Police and the Directorate of Criminal Investigations to do background checks on the directors of betting firms within 24 hours and said he had no problem signing deportation letters against them.

Two weeks later, the Bulgarians were deported.

CONMAN: Whilst publicly posturing against betting, Fred Matiangi secretly gave clearance for a private jet ferrying Bulgarian criminal Gerasim Nikolov to land at JKIA and meet Safaricom officials.

* * * * *

There is still one puzzle in the story of SportPesa’s meteoric rise to the top, and its spectacular crash: its numbers just do not seem to add up. For instance, the firm declared revenue (bets placed) of Sh149.7 billion in 2018. This was a 35 per cent growth from Sh111.5 billion in 2017.

On the face of it, these numbers look okay. But the 2019 population census estimated Kenya’s population at 48 million, with a median age of 19. Gambling is illegal for anyone under the age of 18, so that leaves Kenya’s adult population, at approximately 25 million, as SportPesa’s legal clients. To make this money, every Kenyan of legal gambling age in 2018 would have to have wagered Sh6,000 with just one company.

This is a puzzle that even economists are struggling to crack, especially given the fact that an Ipsos survey from 2018 claimed that around half of all Kenya’s households (not individuals) made less than Sh10,000 in a month.

“These numbers are too big. Kenyans were betting, but Sh150 billion for just one company? We must all be missing something. What must be confirmed is whether for sure SportPesa really paid out in excess of Sh120 billion because that is really a lot of money,” Tony Watima, an economist, said.

“That is about half of what the Teachers Service Commission uses to pay teachers. Or is the same as what tea farmers receive as bonuses. There is no way such money can move into the economy and people on the ground do not feel it,” Watima added.

What is not in doubt, however, is the fact that the exit of SportPesa left punters disappointed. The firm had built a trustworthy brand that paid on time and had mouthwatering jackpots to look forward to. Can it rise from the ashes like the proverbial phoenix? Or has its goose been well and truly cooked? Only time will tell

Extracted from an article By Paul Wafula Nation Media Group